»The Value Dividend Strategy« 1-Year Performance

1-Year Performance Review of The Value Dividend Strategy from 10/2022 to 10/2023

In my book The Value Dividend Strategy, which was published at the end of November 2002, I provided readers with two portfolios that at the time met the criteria of Value Dividend stocks. This article analyzes the performance of these portfolios after one year.

Background

On October 21, 2022, I screened the U.S. stock market against the criteria of The Value Dividend Strategy. As a result, I created two portfolios: one focused on value stocks that paid significantly high dividends, and one focused on value stocks that paid no dividends at all.

In this performance review, we will evaluate the one-year performance of the two portfolios I created as of October 2022. Due to the publication date of my book, this performance review looks at the 1-year performance from October 21, 2022 through October 20, 2023. In the future, I will track and publish performance updates on an annual basis from January 1 through December 31. Therefore, as a subscriber, you can expect updated Value & Dividend portfolios on January 1st, 2024.

At the time of creation, all stocks in the Value & Dividend portfolios had a low price-to-earnings ratio, high or no dividend payments, an Altman Z-score of <2.99, a Piotroski F-score of <6, and an equity-to-asset ratio of <0.5.

Incidentally, in my book I emphasized that the value dividend strategy is particularly effective and yields the best returns when implemented toward the end of a recession. Keep in mind that this was not the case on October 21, 2022.

The Dividend Portfolio

The high dividend Value Dividend Strategy portfolio consisted of 14 stocks.

The 1-year performance since inception of the portfolio is 17.31% excluding dividends paid.

The average dividend yield of this portfolio at inception was 4.2%.

The average performance was 17% with a standard deviation of 21%.

The average dividend yield was approximately 4.19% with a standard deviation of 1.84%. This indicates a wide range of dividend yields among the companies, with a maximum yield of 8.98%.

Hypothetically, if we'd only invested in the five best performing stocks, we could have returned 38% on undervalued value stocks.

The question I'll be answering in this publication through selected deep dives is how we can identify these winners early. If you haven't already, please consider subscribing.

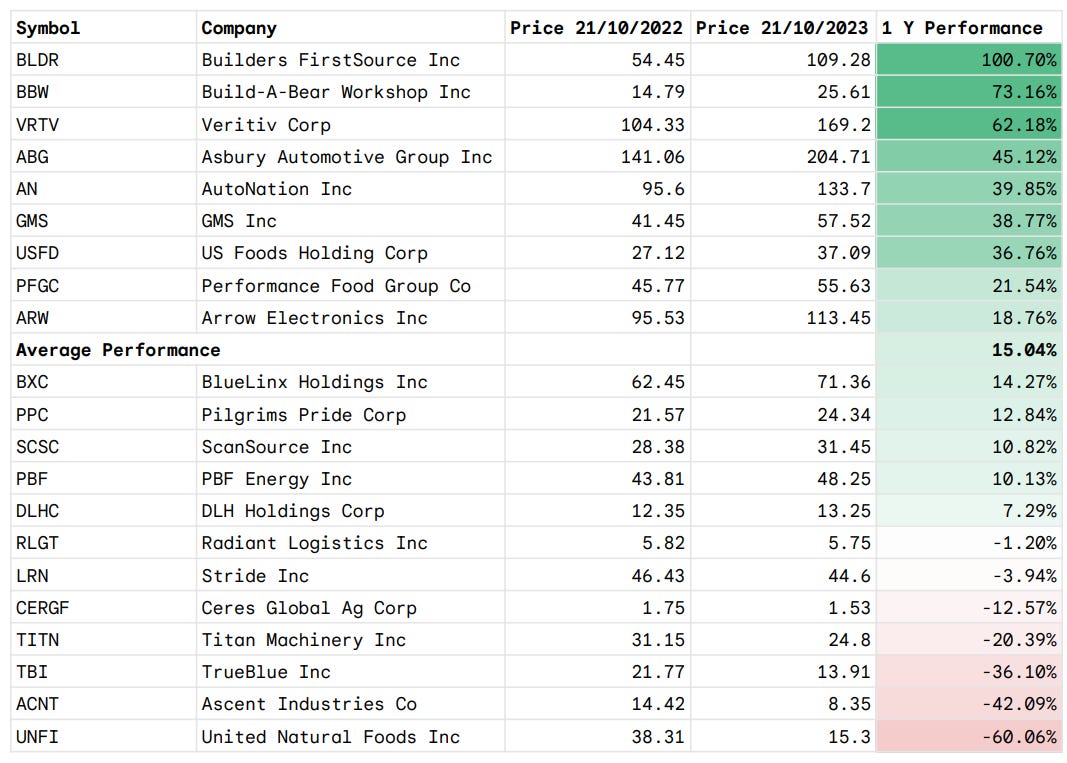

The Non-Dividend Portfolio

The non-dividend paying Value Dividend portfolio consisted of 21 stocks.

The total 1-year performance since the portfolio's inception is 15.04%.

The Value Dividend portfolio, which pays no dividends, had an average performance of 15% with a standard deviation of 36%. This standard deviation is quite high as some stocks performed exceptionally well (100.70%) while others had large losses (-60.06%).

Hypothetically, investing in the 5 best performing stocks would have resulted in a 64% gain - on low P/B value stocks!

With non-dividend paying value stocks, the challenge is to weed out the bad performers while focusing on the high performers. That is what I will be focusing on in this newsletter. If you haven't already, please consider subscribing.

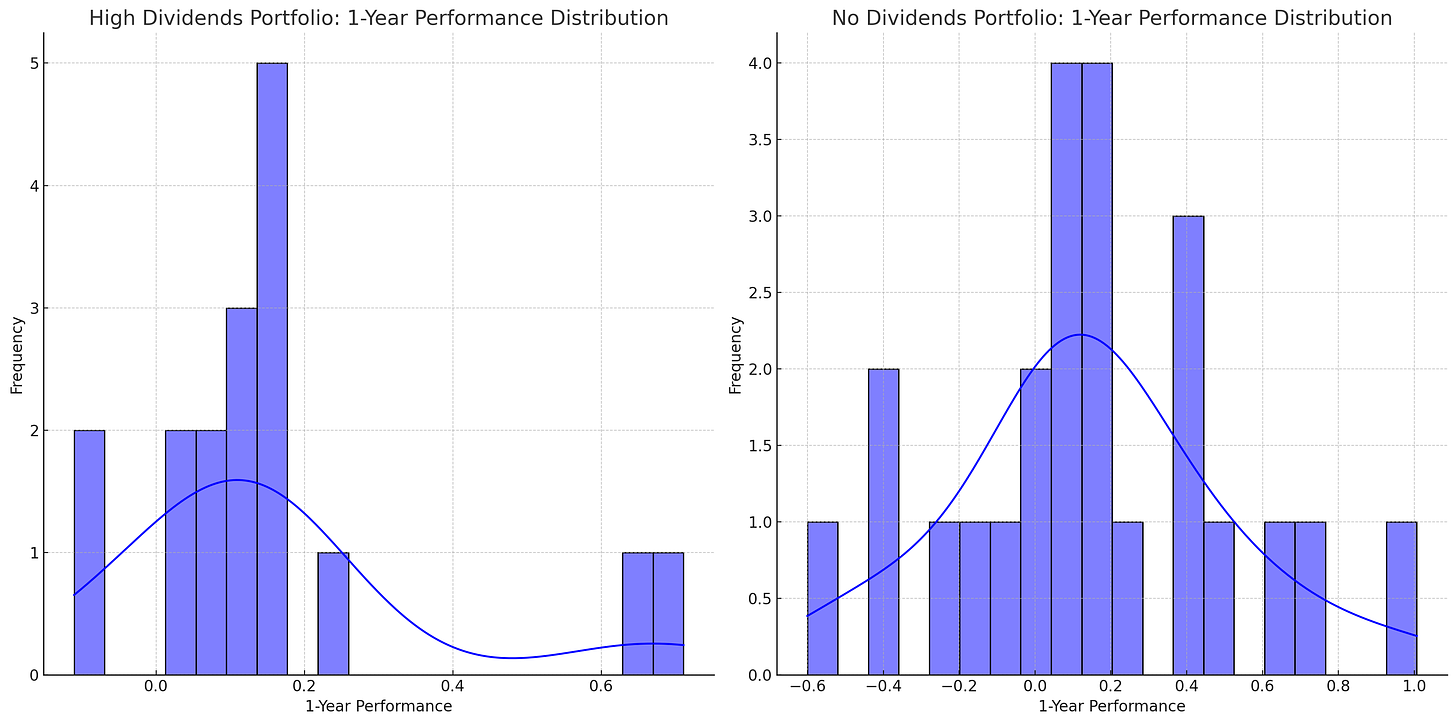

Distributions

The Dividend Portfolio shows a more or less normally distributed performance curve, with most stocks clustered around moderate returns. This distribution suggests a relatively stable and less volatile investment landscape where gains are modest but more consistent.

On the other hand, the non-dividend portfolio has an intriguingly skewed performance distribution, with returns spread over a wider range, including some significant outliers. This implies a higher risk/reward profile, with both significant upside potential and downside risk.

Interestingly, the data shows that this higher volatility is positively correlated with lower price-to-book ratios, suggesting that undervaluation may be a catalyst for these extreme performances.

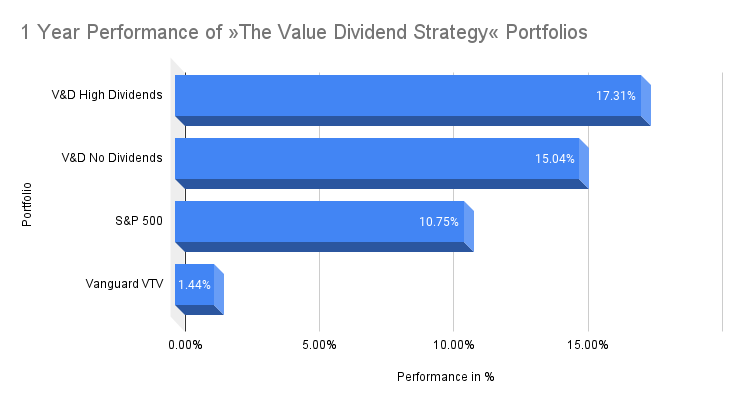

Outpacing the Indices

Let's put those performances into perspective. Over the same period, the S&P 500 gained a respectable 10.75% and the Vanguard Value Index Fund ETF (VTV) lagged with a modest gain of 1.44%.

In stark contrast, both Value Dividend Strategy portfolios delivered returns that significantly outperformed these benchmarks.

The Dividend Portfolio outperformed the S&P 500 by 61% and the VTV Index by 1.100%.

The non-dividend portfolio outperformed the S&P 500 by 40% and the VTV Index by 942%.

This serves as a powerful assertion that the Value Dividend Strategy may be more than just a theoretical construct - it may be a roadmap for achieving superior returns with undervalued stocks.

As a result, I will be constructing Value Dividend Strategy portfolios on January 1 of each year, including an annual performance review. If you haven't already, please consider subscribing.

If you want to learn more on how I discovered this strategy and how the portfolios were created, you can read my book online or order a copy from amazon.com.

Closing Remarks

Since the publication of my book, The Value Dividend Strategy, we can see that value dividend portfolios continue to outperform the index and large diversified value portfolios. With this newsletter and blog, I will continue to update, refine and expand The Value Dividend Strategy. I will dive deep into select promising or suspect value dividend stocks to find clear winners and losers within the small universe of value dividend stocks.

If you haven't already done so, I invite you to join the Value & Dividends community and I look forward to your subscription to this publication.

Sincerely,

Marius Schober

Twitter: @mariusschober

LinkedIn: Marius Schober

Legal Disclaimer

The content provided in this newsletter is for informational purposes only. The information, analysis, and opinions expressed herein are solely those of Marius Schober and do not represent, reflect or express the views of any other person or entity.

This newsletter does not constitute investment advice, financial advice, trading advice, or any other sort of advice, and you should not treat any of the newsletter's content as such. Marius Schober does not recommend that any securities, transactions, or investment strategies mentioned in this newsletter are suitable for any specific person.

The information provided in this newsletter is obtained from sources believed to be reliable, but Marius Schober does not guarantee its completeness or accuracy, or warrant its completeness or accuracy. Readers are urged to consult with their own independent financial advisors with respect to any investment.

All information and content in this newsletter are subject to change without notice. Prices, quotes, and other financial information may be out of date or inaccurate. Past performance is not indicative of future results. Investing in securities involves risks, including the potential loss of all amounts invested.

Marius Schober does not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

By subscribing to this newsletter, you acknowledge and agree to the terms of this disclaimer.