2024 Portfolios for »The Value Dividend Strategy«

2024/01/01 Portfolios According to »The Value Dividend Strategy«

Today is Monday, 1st January 2024 and I created two new Value Dividend Portfolios. One portfolio representing undervalued stocks with no dividend payment and the second portfolio undervalued stocks with significantly high dividend payments.

If you want to learn more on how I discovered this strategy and how the portfolios were created, you can read my book online or order a copy from amazon.com.

2024 Portfolios

Both portfolios focus solely on the U.S. market and have the following in common:

Piotroski F-score of ≥ 6.00

Altman Z-score of ≥ 3.00

Equity Ratio of ≥ 50.00%

The first portfolio paying no dividends focuses on stocks with:

P/E ratio of ≤ 10

Dividend yield of 0%

The second portfolio paying significant dividends focuses on stocks with:

P/E ratio of ≤ 7

Dividend yield ≥ 2.9%

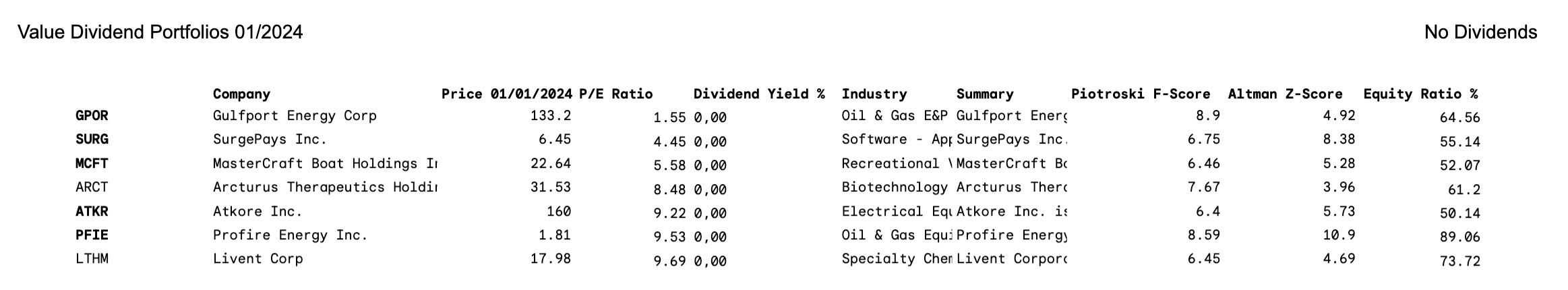

1. 2024 No Dividend Portfolio

»The Value Dividend Strategy« portfolio paying no dividends consists in total of 7 stocks:

Gulfport Energy Corp GPOR 0.00%↑ with a current price of $133.20

SurgePays Inc. SURG 0.00%↑ with a current price of $6.45

MasterCraft Boat Holdings Inc. MCFT 0.00%↑ with a current price of $22.64

Arcturus Therapeutics Holdings Inc. ARCT 0.00%↑ with a current price of $31.53

Atkore Inc. ATKR 0.00%↑ with a current price of $160.00

Profire Energy Inc. PFIE 0.00%↑ with a current price of $1.81

Livent Corp LTHM 0.00%↑ with a current price of $17.98

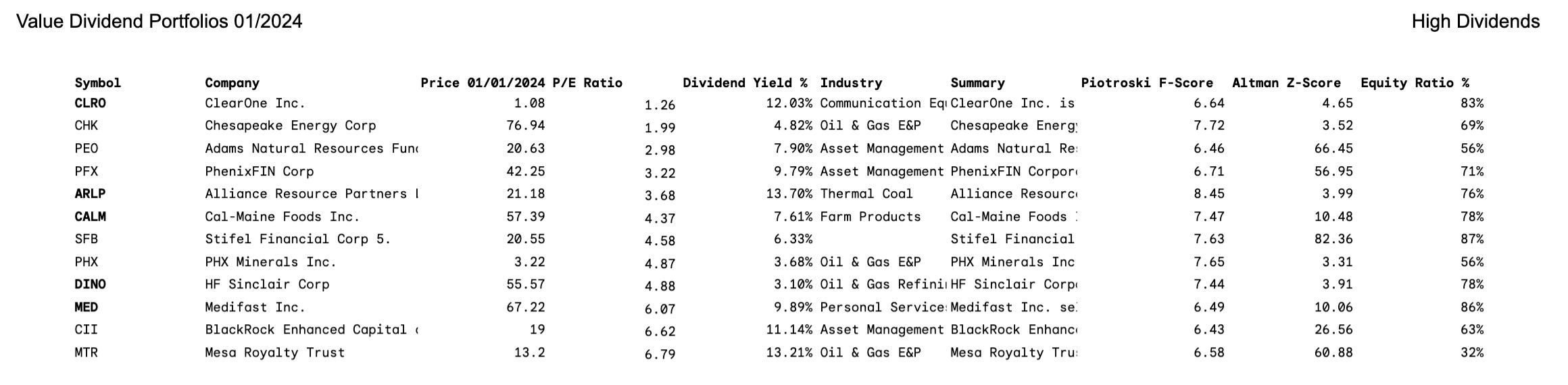

2. 2024 High Dividend Portfolio

»The Value Dividend Strategy« portfolio paying significantly high dividends consists in total of 12 stocks:

ClearOne Inc. CLRO 0.00%↑ with a current price of $1.08

Chesapeake Energy Corp CHK 0.00%↑ with a current price of $76.94

Adams Natural Resources Fund Inc. PEO 0.00%↑ with a current price of $20.63

PhenixFIN Corp PFX 0.00%↑ with a current price of $42.25

Alliance Resource Partners L.P. ARLP 0.00%↑ with a current price of $21.18

Cal-Maine Foods Inc. CALM 0.00%↑ with a current price of $57.39

Stifel Financial Corp 5. SFB 0.00%↑ with a current price of $20.55

PHX Minerals Inc. PHX 0.00%↑ with a current price of $3.22

HF Sinclair Corp DINO 0.00%↑ with a current price of $55.57

Medifast Inc. MED 0.00%↑ with a current price of $67.22

BlackRock Enhanced Capital and Income Fund Inc. CII 0.00%↑ with a current price of $19.00

Mesa Royalty Trust MTR 0.00%↑ with a current price of $13.20

Outlook

Both portfolios have been created solely by stock screening. As shown in »The Value Dividend Strategy«, these portfolios have performed exceptionally fine historically. I highlighted the most promising companies in bold.

This time I’ll look into each company in detail. I will perform a proper due diligence and valuation of each stock to create a third »The Value Dividend Strategy« portfolio with the aim of identifying winners while excluding any company raising a red flag. I might also write deep dives on the most promising stocks.

Subscribe to this newsletter if you wish to receive this portfolio and any deep dives I might write!

If you want to learn more on how I discovered this strategy and how the portfolios were created, you can read my book online or order a copy from amazon.com.

Legal Disclaimer

The content provided in this newsletter is for informational purposes only. The information, analysis, and opinions expressed herein are solely those of Marius Schober and do not represent, reflect or express the views of any other person or entity.

This newsletter does not constitute investment advice, financial advice, trading advice, or any other sort of advice, and you should not treat any of the newsletter's content as such. Marius Schober does not recommend that any securities, transactions, or investment strategies mentioned in this newsletter are suitable for any specific person.

The information provided in this newsletter is obtained from sources believed to be reliable, but Marius Schober does not guarantee its completeness or accuracy, or warrant its completeness or accuracy. Readers are urged to consult with their own independent financial advisors with respect to any investment.

All information and content in this newsletter are subject to change without notice. Prices, quotes, and other financial information may be out of date or inaccurate. Past performance is not indicative of future results. Investing in securities involves risks, including the potential loss of all amounts invested.

Marius Schober does not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

By subscribing to this newsletter, you acknowledge and agree to the terms of this disclaimer.