Explosive Potential in Undervalued Stocks

Introduction – How Value- And Growth Investors May Identify Undervalued Value-Dividend-Stocks Which Outperform the Market.

Dear readers,

My name is Marius Schober and I welcome you to my new Substack newsletter. In Value & Dividends, I’m covering undervalued growth and dividend stocks. They fall into the value category, but exhibit characteristics of growth or dividend stocks. But before we dive into the topic, I’d like to talk about value.

Ultimately, value is what we seek in life. Not only do we seek value as investors, but we seek value in everything we do: how and with whom we spend our time, the books we read, the stocks we invest in, and the values we aspire to.

Measuring Value

When we spend our time, we want to spend every minute of it wisely. In a way that it is useful or fulfilling. Useful means we use our time in a way that we receive a return for it. Whether we are learning and acquiring a new skill, working out to maintain our health, or investing money to receive a monetary return. Ideally, the time that we spent useful also fulfills us. The good thing: If not, the time we spent useful is nevertheless valuable because we receive a return on our time. Whether it is a new skill, health, or money. Time spent useful is measurable, for example by taking a test, measuring the BMI or the weight you can bench press, how fast you can run a mile, and simply how much money is in your bank account. However, the most valuable and precious time is not measurable. We cannot measure the perceived value from love, joy, and happiness. Still, it is what we long for the most.

Defining and living according to our values – meaning how we align our actions and decisions with a set of personal or moral principles – can guide us towards personal satisfaction, fulfillment, and a sense of purpose.

What is most valuable to us – which is the sum of love, joy, happiness, fulfillment, and purpose – is the result of activities we cannot measure.

Only when we understand and respect the unmeasurable can we understand the true value of something.

Let’s make the transition to investing. Finding an undervalued stock is mostly about the unmeasurable. By looking only at facts presented to us in financial reports and AI-powered stock screeners, we locate undervalued businesses in seconds, but we will miss the whole picture.

We cannot properly value a stock without understanding the unmeasurable first. A stock may look attractive at first, but after understanding the unmeasurable, it becomes unappealing. Just as a stock may look unappealing at first, but after understanding the unmeasurable, it becomes attractive.

The Unmeasurable Value

In business and investing, most value is hidden to most entrepreneurs and investors. The greatest entrepreneurs and investors see and understand something most others don’t. They grasp and understand the unmeasurable.

The measurable includes financial data and tangible assets, such as cash, property, inventory.

The unmeasurable is more difficult to grasp and quantify. It may include a visionary CEO, brand reputation, intellectual property, company culture, and a monopolistic product serving a yet invisible future market.

What most value investors managed to master is determining an intrinsic value of a stock based on tangible criteria such as financial data and metrics. When it comes to discovering unmeasurable value – for example competitive advantages and monopolistic product offerings – the wheat gets separated from the chaff. To understand and then assess the unmeasurable value of a business one must not only understand the macro outlook of an entire industry but also understand how exponential technologies will shape our future. So, is the skill to discover and then assess the value of the unmeasurable is reserved to a selected few visionary value investors?

Predicting the Future

Cathie Woods is one prominent investor among many visionary growth investors who have a great understanding and vision of how our future will be formed by exponential technologies. As a result, these visionary growth investors are betting on certain companies which – they think – will shape the future. Cathie Woods’ investment company Ark Invest and a some other investors arguably do a superb job in understanding exponential technologies and spotting industries which are going to change forever due to disruptive innovation. Unluckily, they do so seemingly unimpressed by measurable financial valuations and – until recently – a zero-interest economy where many investors got blinded by the excitement for a drastically advanced future.

Cathie Woods and many like-minded investors, entrepreneurs, and venture capitalists in Silicon Valley and Shenzhen have quite a good understanding of exponential technologies and how they will definitely impact our future. By following and learning from these individuals, it is not too difficult to understand what the future will look like.

Tapping into the Unmeasurable

Most investors make the mistake and put value investing and growth investing in two distinctively different categories. It is either or. To some extent, which means before the hype arrived, value investing and growth investing can work hand-in-hand. But to identify this invisible and unmeasurable value, we need new approaches to identify and evaluate these “value-growth stocks”. The reward for investors who can spot and invest in the right “value-growth-stocks” at the right time will be significant. These companies are undervalued according to value investing principles and – due to a lack of dividends or an extraordinary high dividend – are often omitted by value investors as they deem them too risky. What value investors miss – however – is that the management of these companies know something that the majority of investors miss.

Value Dividend Stocks

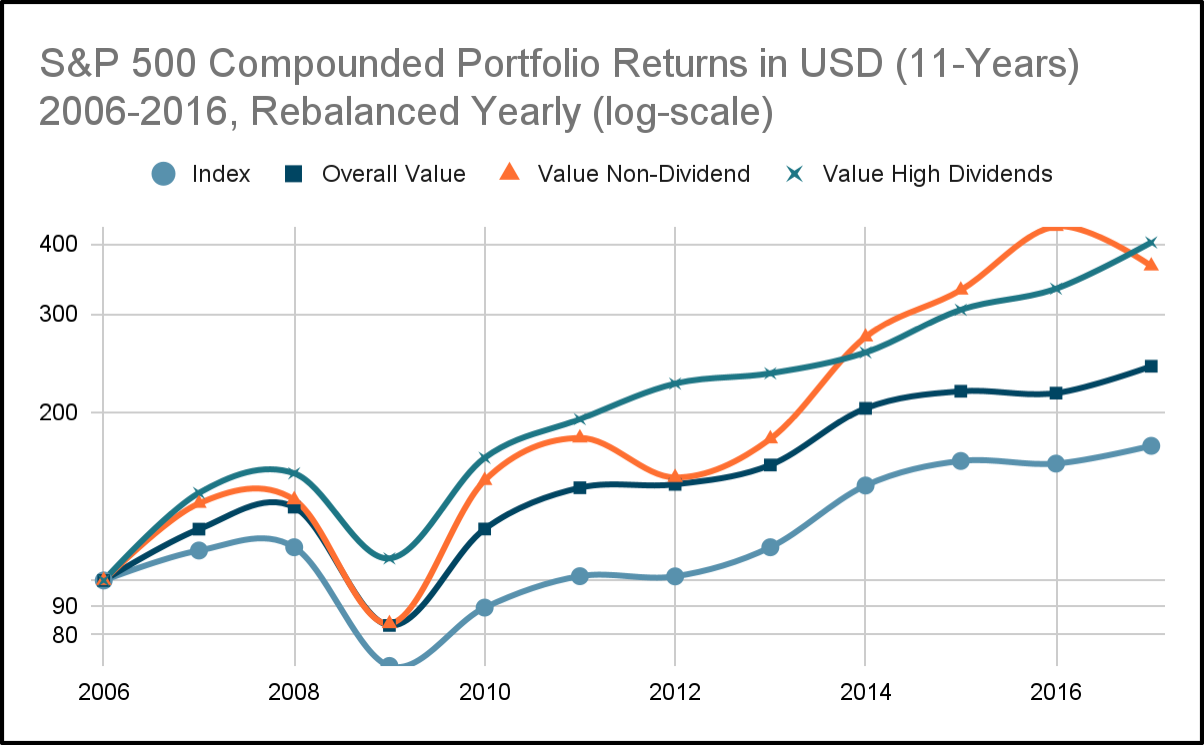

In a 2017 study, I looked at value stocks which either pay an extremely high or no dividend at all. The unpopular outsiders few value investors want to touch. As it turned out, both categories – undervalued stocks which pay a significantly high dividend and undervalued stocks which pay no dividend at all – outperformed on average not only the market significantly but also their respective value portfolio.

From the research findings, which I summarized in my short book “The Value Dividend Strategy”, we can intelligibly see that the management of these companies is aware of their undervaluation. The management understands something the average investors does not. Despite an undervaluation, these companies refuse to pay dividends, for example to use dividend cuts as a cheap source of capital to invest in profitable future projects and indicate investors that they have profitable investment and growth opportunities at hand. Companies who pay a significantly high dividend have – in the best case – already gone through multiple steps to use their free cash flow in a shareholder-friendly way, which includes reinvestment into the future growth, acquisitions, share repurchases and debt reduction.

In both cases – undervalued companies which pay a significant dividend and companies who pay none – investors can find value-growth-stock gems. These are companies inherently undervalued despite having or working on a competitive advantage which guarantees them a fruitful future. I call these stocks value dividend stocks.

The Value & Dividends Briefing

In this newsletter, I am (un)covering value dividend stocks. If you are interested in specific investment ideas based on the value-dividend strategy, analysis of macro risks and chances, deep dives into very promising value dividend stocks and monthly stock picks, then I’m happy to welcome you as a free or paying subscriber.

Click here if you would like to learn more about this newsletter and the differences between the paid and free version of it.

If you want to dive deeper you can get my short book “The Value Dividend Strategy” at Amazon.

Sincerely yours,

Marius Schober

Twitter: @mariusschober

LinkedIn: Marius Schober

Legal Disclaimer

The content provided in this newsletter is for informational purposes only. The information, analysis, and opinions expressed herein are solely those of Marius Schober and do not represent, reflect or express the views of any other person or entity.

This newsletter does not constitute investment advice, financial advice, trading advice, or any other sort of advice, and you should not treat any of the newsletter's content as such. Marius Schober does not recommend that any securities, transactions, or investment strategies mentioned in this newsletter are suitable for any specific person.

The information provided in this newsletter is obtained from sources believed to be reliable, but Marius Schober does not guarantee its completeness or accuracy, or warrant its completeness or accuracy. Readers are urged to consult with their own independent financial advisors with respect to any investment.

All information and content in this newsletter are subject to change without notice. Prices, quotes, and other financial information may be out of date or inaccurate. Past performance is not indicative of future results. Investing in securities involves risks, including the potential loss of all amounts invested.

Marius Schober does not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

By subscribing to this newsletter, you acknowledge and agree to the terms of this disclaimer.